What Does Estate Planning Attorney Mean?

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Table of ContentsThe Ultimate Guide To Estate Planning AttorneyThe Main Principles Of Estate Planning Attorney Estate Planning Attorney Things To Know Before You Get ThisUnknown Facts About Estate Planning Attorney

Your lawyer will certainly also help you make your papers authorities, preparing for witnesses and notary public signatures as required, so you don't need to bother with attempting to do that final step on your own - Estate Planning Attorney. Last, but not the very least, there is beneficial assurance in developing a partnership with an estate preparation lawyer that can be there for you later onPut simply, estate planning lawyers give worth in numerous ways, much past simply offering you with published wills, trusts, or various other estate preparing files. If you have questions about the procedure and intend to discover more, call our office today.

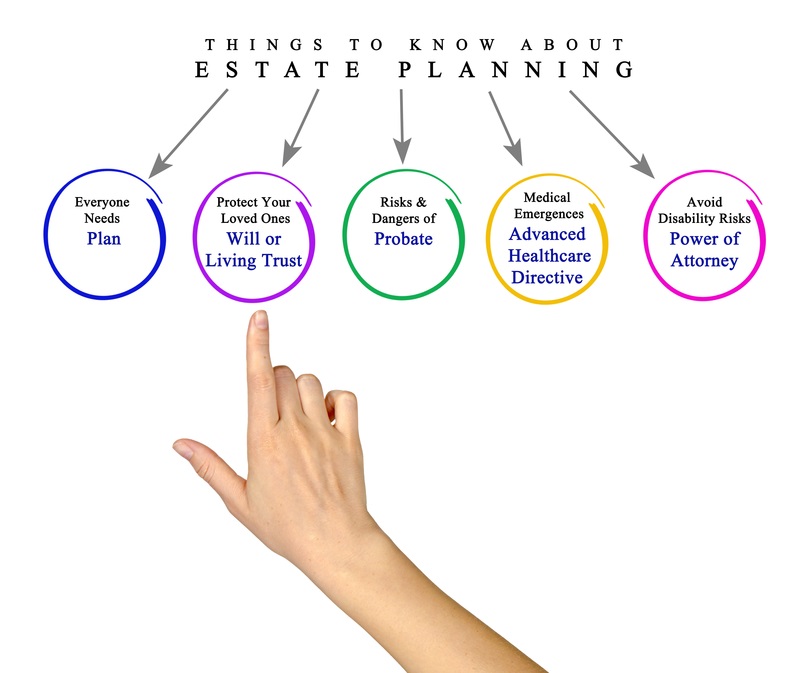

An estate preparation lawyer helps you define end-of-life decisions and legal records. They can set up wills, develop depends on, produce healthcare directives, develop power of attorney, create sequence plans, and a lot more, according to your wishes. Dealing with an estate planning lawyer to complete and manage this legal paperwork can assist you in the following 8 areas: Estate preparing attorneys are specialists in your state's trust, probate, and tax obligation laws.

If you do not have a will, the state can choose just how to divide your properties among your beneficiaries, which might not be according to your desires. An estate preparation attorney can aid organize all your legal records and distribute your assets as you desire, potentially preventing probate. Many people draft estate planning papers and then forget them.

Get This Report about Estate Planning Attorney

When a client passes away, an estate plan would dictate the dispersal of possessions per the deceased's directions. Estate Planning Attorney. Without an estate plan, these decisions may be left to the near relative or the state. Duties of estate planners include: Developing a last will and testimony Establishing trust fund accounts Calling an administrator and power of lawyers Determining all beneficiaries Naming a guardian for small youngsters Paying all debts and decreasing all tax obligations and lawful fees Crafting instructions for passing your worths Establishing choices for funeral setups Wrapping up instructions for treatment if you come to be unwell and are not able to choose Getting life insurance policy, disability revenue insurance, and lasting care insurance coverage An excellent estate plan must be updated consistently as clients' economic situations, individual inspirations, and federal and state legislations all advance

As with any profession, there are qualities and skills that can assist you achieve these goals you can find out more as you work with your clients in an estate planner function. An estate planning occupation can be ideal for you if you possess the complying with qualities: Being an estate coordinator suggests believing in the lengthy term.

About Estate Planning Attorney

You must help your customer anticipate his/her end of life and what will happen postmortem, while at the same time not home on somber thoughts or emotions. Some customers may become bitter or troubled when considering fatality and it could be up to you to assist them click here for more info with it.

In case of fatality, you may be anticipated to have many discussions you could look here and negotiations with surviving household participants about the estate strategy. In order to succeed as an estate planner, you may require to stroll a great line of being a shoulder to lean on and the individual depended on to interact estate planning matters in a prompt and specialist manner.

tax code transformed thousands of times in the ten years between 2001 and 2012. Anticipate that it has actually been altered even more ever since. Relying on your client's monetary earnings bracket, which might progress toward end-of-life, you as an estate coordinator will need to keep your customer's assets in full legal compliance with any type of regional, government, or worldwide tax obligation legislations.

The Of Estate Planning Attorney

Acquiring this certification from companies like the National Institute of Certified Estate Planners, Inc. can be a strong differentiator. Belonging to these professional groups can verify your abilities, making you much more eye-catching in the eyes of a potential client. In addition to the psychological benefit of assisting clients with end-of-life planning, estate organizers enjoy the advantages of a stable earnings.

Estate preparation is a smart thing to do no matter of your present health and financial condition. The very first important point is to work with an estate planning lawyer to assist you with it.

A knowledgeable lawyer understands what details to include in the will, including your beneficiaries and special considerations. It also gives the swiftest and most effective approach to transfer your properties to your beneficiaries.